The Ripple Effect of Minimum Commitments in API Monetization

Why Minimum Commitments are Hindering Companies and How Fair Pay-As-You-Go Models are Offering a Solution

The startup world is no stranger to hype. This was evident at the beginning of 2021 when VC-backed companies were being valued at tens to hundreds (and in some cases even a thousand) times their revenue. The number of unicorns minted in 2021 was far greater than in the past five years combined. Investors were pouring money into these companies, believing that they would achieve the milestones necessary to sustain their given valuation, even if that meant getting millions more users or dollars in a single year.

This blinded positivity gave an opening for several companies to demand minimum commitments on their services in par with the unrealistic growth their potential clients had projected. Services that were priced on an API-call basis started looking more like subscription services, having annual recurring revenues due to the set minimum commitments they had signed.

But why are minimum commitments so problematic for startups? To provide an easy example lets use a crypto exchange such as Coinbase.

Note: this is an example and by no means factual, just an easy way to understand this. Numbers are true though, here is the data in case you might want it.

Coinbase grew from 2.8mm MAUs in 2020 to 8.8mm MAUs in 2021 (a 3.14x increase in a year. The company was riding high on the crypto boom, and it seemed like growth was just getting started. Growing at the same rate as the past year and reaching 27mm MAUs (8.8mm x 3.14) in 2022 could be not only attainable but conservative.

Around 15% of all users are active on Coinbase, meaning that if Coinbase reached 27mm MAUs in 2022, it would have a grand total of 180mm users, adding around 130mm users in 2021 alone.

That number is off by almost 100 million users.

For every user, there is an onboarding cost by a KYC vendor. For the purpose of this exercise lets price it as $1 per onboarding (prices for these vary significantly by data requested and jurisdiction, but from my experience $1 is a fair assumption).

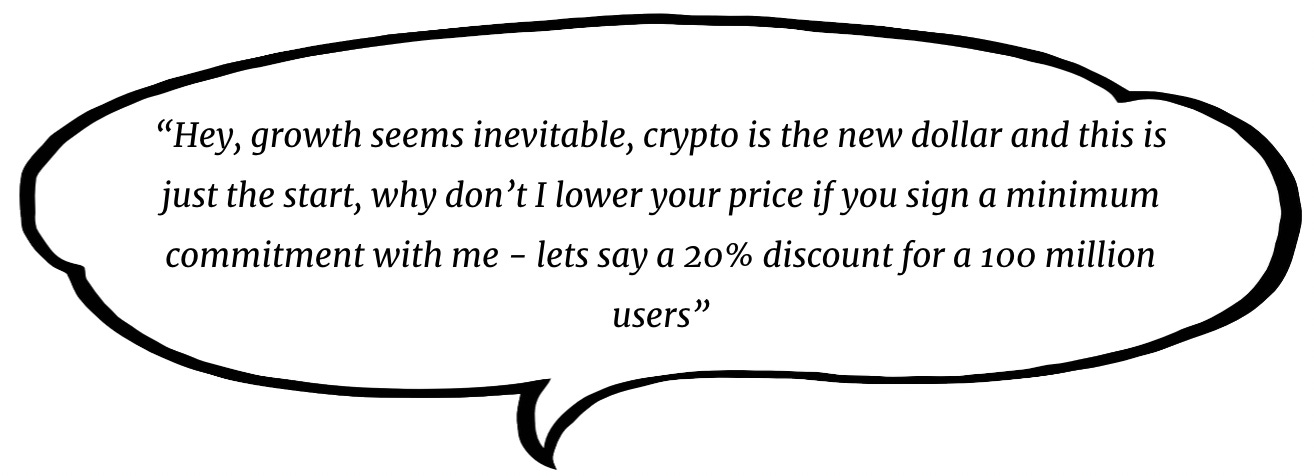

If I am the KYC vendor sales person, I could easily tell Coinbase:

Seems fair, you would only have to grow 2.7x compared to the 3.14x you grew the past year to reach the commitment.

This would bring the grand total you need to pay for KYC checks - irregardless of how many you actually do - to: $80,000,000

In contrast, in 2021, Coinbase added 42 million users to the platform, spending $33.6 million on KYC checks and giving their vendor $66.4 million for free, assuming this example was true.

Why do vendors prefer minimum commitments? It's not just to secure their revenues. For vendors, tracking the number of API calls is complex and operationally heavy. It requires monitoring server logs, analyzing usage patterns, and maintaining complex billing systems. Minimum commitments allow vendors to predict their revenues and plan their resources accordingly.

I have worked with these types of contracts before and although they can be extended, and there may be ways to avoid payments, the most important takeaway is to understand how minimum commitments can hinder startups. It is crucial for vendors who are not providing a SaaS to move away from searching for recurring revenues through MCs and instead provide a fair pay-as-you-go model.

An interesting company tackling this issue is Blobr, a French startup that recently raised $5.4 million led by 10X Founders. The company's platform allows businesses that have developed their APIs to sell API access without the need for technical knowledge or the use of internal engineering resources. By uploading the technical document that defines the structure of their API to Blobr, businesses can generate a branded developer portal with different tiers and price points, and handle usage, billing, and more. Blobr's no-code technology empowers businesses to monetize their APIs without minimum commitments, offering a fair pay-as-you-go model instead.

In the fast-paced startup world, it's easy to get caught up in the hype of explosive growth and high valuations. However, this often leads to unrealistic expectations and minimum commitments that can be detrimental to a startup's financial health. It's important for vendors to move away from recurring revenue through MCs and provide a fair pay-as-you-go model. Innovative solutions like Blobr's platform can help businesses monetize their APIs without the need for minimum commitments. As the startup landscape continues to evolve, it's essential to maintain a balanced approach and avoid succumbing to the pressure of unrealistic projections. By doing so, we can foster a sustainable and thriving startup ecosystem.